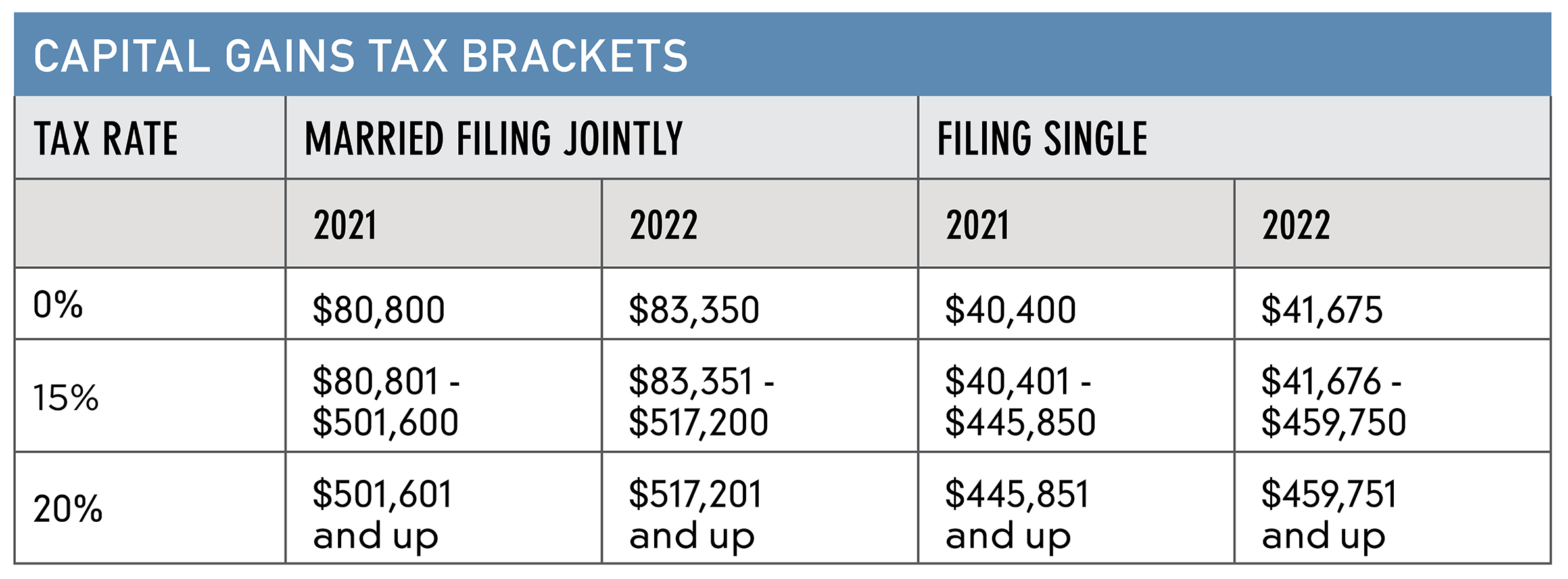

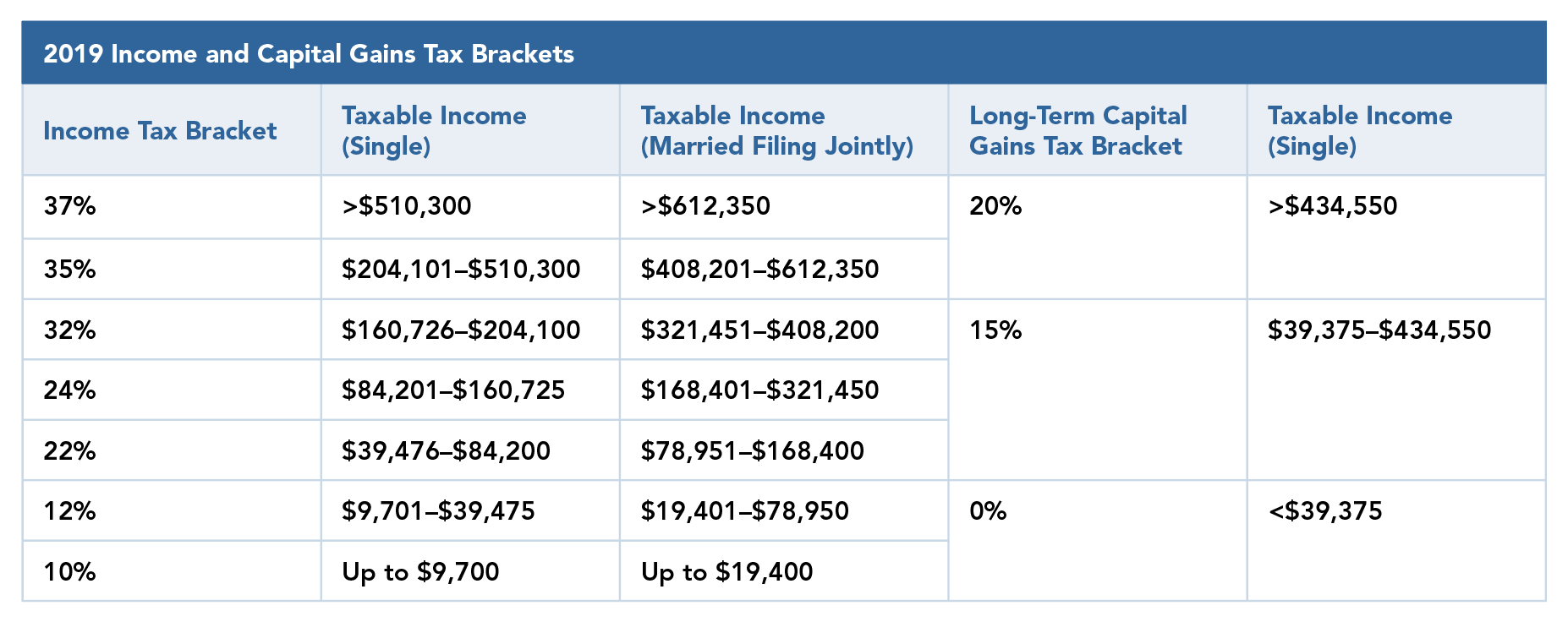

Capital Gains Tax On Stocks 2025. Capital gains are reported on schedule d, which is submitted with your federal tax return by april 15, 2025, or oct. Any profit you make from selling a stock is taxable at either 0%, 15% or 20% if you held the shares for more than a year.

Any profit you make from selling a stock is taxable at either 0%, 15% or 20% if you held the shares for more than a year.

pihak berkuasa tempatan pengerang, The following gains are generally not taxable: Key takeaways capital gains taxes are due only.

Understanding Capital Gains Tax A Comprehensive Guide, Key takeaways capital gains taxes are due only. Profits or losses derived from the buying and selling of shares.

Bangkok Post Final cryptocurrency levy talk on Jan 20, Capital gains are reported on schedule d, which is submitted with your federal tax return by april 15, 2025, or oct. For the 2025 tax year, you won’t pay any capital gains tax if your total taxable income is $47,025 or less.

Capital Gains Tax On Real Estate Investment Property 2019, Here's a breakdown of how capital gains are taxed for 2025. Profits or losses derived from the buying and selling of shares.

ShortTerm And LongTerm Capital Gains Tax Rates By, 15, 2025, with an extension. Uncle sam gets a cut of what you make.

Cuddy Financial Services's Tax Planning Guide 2025 Tax Planning Guide, This calculator only calculates capital gains for the sale of canadian assets and assets in countries with whom canada does not have a tax treaty. Gains derived from the sale of a property in singapore as it is a capital gain.

Capital Gains tax on residential property the 30day rule — Bradley, There are two main categories for capital gains: Newly announced inflation adjustments from the irs will tweak the rules on.

Understanding the Capital Gains Tax A Case Study, The capital gains tax rate that applies to profits from the sale of stocks, mutual funds or other capital assets held for more than one year (i.e., for. Gains derived from the sale of a property in singapore as it is a capital gain.

Short Term And Long Term Capital Gains Tax Rates By Free, Profits or losses derived from the buying and selling of shares. 15, 2025, with an extension.

Capital Gains Tax Explained? The Kalculators, Single tax filers can benefit from the. Gains derived from the sale of a property in singapore as it is a capital gain.